Cyberbullying Facts & Statistics (2024)

The Internet of Things: Why now and how big?

Now that it has been established that the Internet of Things is the most hyped “emerging technology” today, and that the term—and the associated technologies—is far from being new, the only question to be answered is Why the sudden surge in interest in 2014?

That’s the question I put to a number of tech luminaries earlier this year. Bob Metcalfe, inventor of the Ethernet and now Professor of Innovation at University of Texas at Austin, is familiar with the sudden prominence of technologies, coming after lengthy incubation periods. Metcalfe points to scribbles like me as the main culprit: “It’s a media phenomenon. Technologies and standards and products and markets emerge slowly, but then suddenly, chaotically, the media latches on and BOOM!—It’s the year of IoT.” Hal Varian, Chief Economist at Google, believes Moore’s Law has something to do with the newfound interest in the IoT: “The price of sensors, processors, and networking has come way down. Since WiFi is now widely deployed, it is relatively easy to add new networked devices to the home and office.”

Janus Bryzek, known as “the father of sensors” (and a VP at Fairchild Semiconductor), thinks there are multiple factors “accelerating the surge” in interest. First, there is the new version of the Internet Protocol, IPv6, “enabling almost unlimited number of devices connected to networks.” Another factor is that four major network providers—Cisco, IBM, GE and Amazon—have decided “to support IoT with network modification, adding Fog layer and planning to add Swarm layer, facilitating dramatic simplification and cost reduction for network connectivity.” Last but not least, Bryzek mentions new forecasts regarding the IoT opportunity, with GE estimating that the “Industrial Internet” has the potential to add $10 to $15 trillion (with a “T”) to global GDP over the next 20 years, and Cisco increasing to $19 trillion its forecast for the economic value created by the “Internet of Everything” in the year 2020. “This is the largest growth in the history of humans,” says Bryzek.

These mind-blowing estimates from companies developing and selling IoT-related products and services, no doubt have helped fuel the media frenzy. But what do the professional prognosticators say? Gartner estimates that IoT product and service suppliers will generate incremental revenue exceeding $300 billion in 2020. IDC forecasts that the worldwide market for IoT solutions will grow from $1.9 trillion in 2013 to $7.1 trillion in 2020.

Other research firms focus on slices of this potentially trillion-dollar market such as connected cars, smart homes, and wearables. Here’s a roundup of estimates and forecasts for various segments of the IoT market:

ABI Research: The installed base of active wireless connected devices will exceed 16 billion in 2014, about 20% more than in 2013. The number of devices will more than double from the current level, with 40.9 billion forecasted for 2020. 75% of the growth between today and the end of the decade will come from non-hub devices: sensor nodes and accessories. The chart above is from ABI’s research on smart cars.

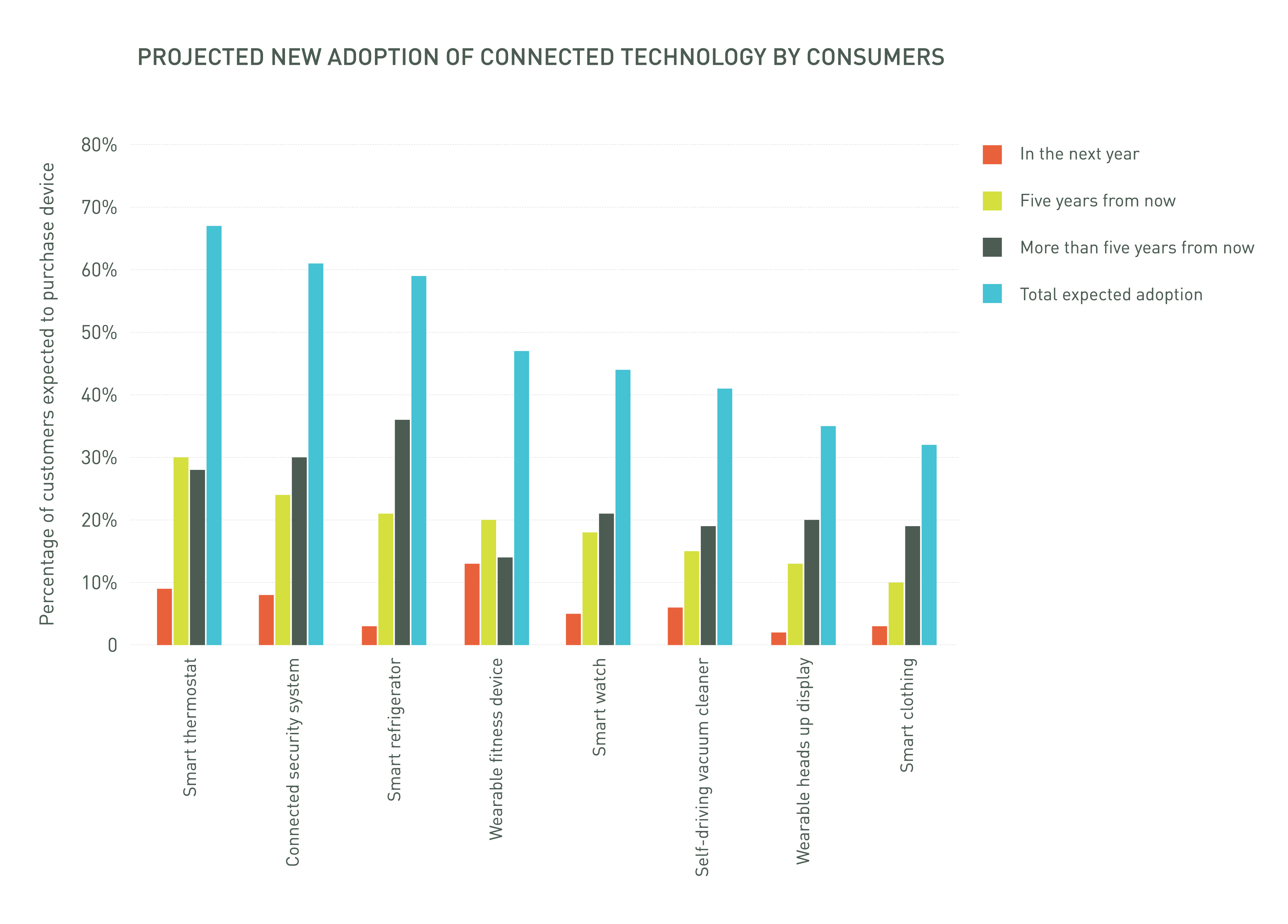

Acquity Group (Accenture Interactive): More than two thirds of consumers plan to buy connected technology for their homes by 2019, and nearly half say the same for wearable technology. Smart thermostats are expected to have 43% adoption in the next five years (see chart below).

IHS Automotive: The number of cars connected to the Internet worldwide will grow more than sixfold to 152 million in 2020 from 23 million in 2013.

Navigant Research: The worldwide installed base of smart meters will grow from 313 million in 2013 to nearly 1.1 billion in 2022.

Morgan Stanley: Driverless cars will generate $1.3 trillion in annual savings in the United States, with over $5.6 trillions of savings worldwide.

Machina Research: Consumer Electronics M2M connections will top 7 billion in 2023, generating $700 billion in annual revenue.

On World: By 2020, there will be over 100 million Internet connected wireless light bulbs and lamps worldwide up from 2.4 million in 2013.

Juniper Research: The wearables market will exceed $1.5 billion in 2014, double its value in 2013–

Endeavour Partners: As of September 2013, one in ten U.S. consumers over the age of 18 owns a modern activity tracker. More than half of U.S. consumers who have owned a modern activity tracker no longer use it. A third of U.S. consumers who have owned one stopped using the device within six months of receiving it.

Originally published on Forbes.com